Get the free form 8836

Show details

Other government official ... Use Form 8836 if the IRS sent this form to you, and you have a qualifying child for the earned income credit (EIC) for 2004. A qualifying child is one ... details on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 8836 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8836 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

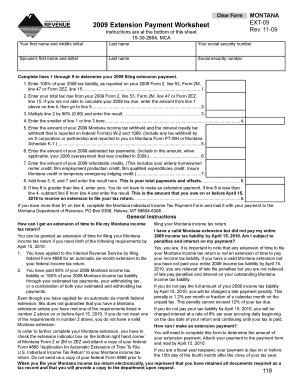

How to edit form 8836 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 8836 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

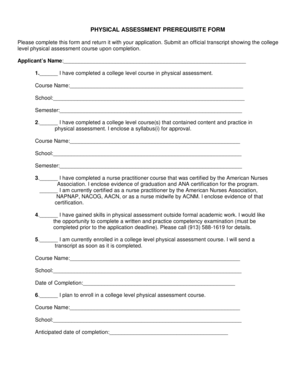

How to fill out form 8836

How to fill out form 8836:

01

Begin by entering your personal information such as your name, address, and social security number in the designated fields.

02

Next, provide details about the qualified alternative fuel vehicle property for which you are claiming the credit. This includes information such as the make, model, and year of the vehicle.

03

Calculate the total cost of the qualified alternative fuel vehicle property and enter it in the appropriate section.

04

Determine the allowable credit amount by referring to the instructions provided with the form and enter it in the designated line.

05

Complete any additional sections or schedules that may be required based on your specific circumstances. This may involve providing details about any credits claimed in previous years or any carryover amounts.

06

Review the completed form for accuracy and make sure all necessary information has been provided.

07

Sign and date the form before submitting it to the appropriate tax authority.

Who needs form 8836:

01

Individuals who have purchased a qualified alternative fuel vehicle property and want to claim a credit for it on their tax return.

02

Taxpayers who meet the eligibility criteria for the alternative motor vehicle credit as provided by the Internal Revenue Service (IRS).

03

Anyone who wants to take advantage of the tax benefits associated with owning and using alternative fuel vehicles.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 8836?

Form 8836 is a tax form used by individuals to claim the residential energy efficient property credit. This credit is available to taxpayers who have installed qualified energy-efficient property in their homes, such as solar panels or solar water heaters. The credit is a percentage of the cost of the property, up to certain limits. Form 8836 is used to calculate the amount of the credit and report it on the taxpayer's federal income tax return.

Who is required to file form 8836?

Form 8836 is required to be filed by individuals or businesses that have qualified plug-in electric drive motor vehicles purchased during the tax year. The purpose of this form is to claim the qualified plug-in electric vehicle credit.

How to fill out form 8836?

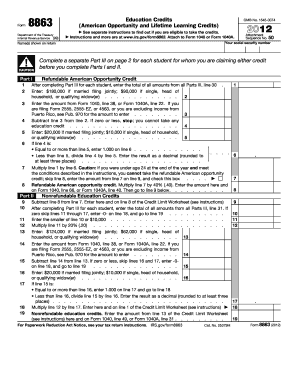

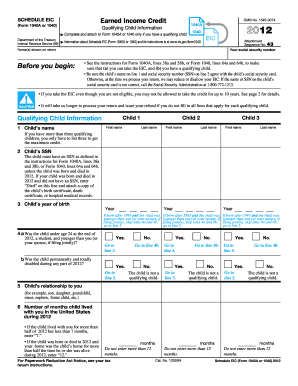

Form 8836, also known as the Qualified Plug-in Electric Drive Motor Vehicle Credit, is a tax form used to claim a credit for certain vehicles that run on electricity or have a hybrid electric-gasoline engine. Here are the steps to fill out the form:

1. Gather necessary information: Collect all the required information before starting the form. This includes details about the vehicle, purchase or lease agreement, and the vehicle's battery capacity.

2. Start the form: Begin by entering your name, Social Security number, and other taxpayer identification information at the top of the form.

3. Part I: In this section, you need to provide information about the vehicle you purchased or leased, including the make, model, and year. Enter the date you acquired the vehicle and the vehicle identification number (VIN). Fill in any other required details about the vehicle's conversion.

4. Part II: This section requires information about the vehicle's battery capacity. Enter the kilowatt-hours (kWh) of the battery pack and the date the vehicle was originally placed into service.

5. Part III: If you are claiming the credit for a new vehicle that was purchased, complete this section. Include the date you purchased the vehicle and the total cost of the vehicle before any trade-in or other credits. If you have any nontaxable use of the vehicle (such as business use), specify it here.

6. Part IV: If you are claiming the credit for a vehicle that was leased, complete this section. Fill in the details of the lease agreement, including the date of the lease, total lease payments, and the portion of the vehicle's cost that is treated as a lease, if any.

7. Part V: Provide information about any credits allowed or paid for the vehicle, including those from related tax returns or any other sources.

8. Part VI: Calculate the credit using the worksheet provided on the form. The calculation depends on the battery capacity and the year the vehicle was purchased or leased. Enter the calculated credit amount on Line 21.

9. Sign and date the form: Once you have completed all the relevant sections, sign and date the form.

Remember to keep a copy of the completed form and any supporting documents for your records. It is also advisable to consult with a tax professional or refer to the IRS instructions for Form 8836 to ensure accuracy and eligibility for the credit.

What is the purpose of form 8836?

Form 8836, also known as the Qualified Electric Vehicle Credit, is used to claim a tax credit for taxpayers who have purchased a qualified electric vehicle. The purpose of this form is to allow eligible individuals to reduce their income tax liability based on the cost of purchasing and installing a qualified electric vehicle. The form helps determine the amount of credit that can be claimed and is necessary to report and calculate any potential tax credits for electric vehicle owners.

What information must be reported on form 8836?

On Form 8836, individuals must report information related to the Qualified Adoption Expenses and the Adoption Credit. The specific information that must be reported includes:

1. Taxpayer identification: Provide your name, Social Security number, and other personal identification details.

2. Adoption expenses: Report the total amount of adoption expenses paid or incurred during the tax year.

3. Adoption credit: Indicate the amount of adoption credit claimed in the current tax year, if any.

4. Carryforward: If you are carrying forward any unused adoption credits from a previous year, report the amount being carried forward.

5. Employer-provided adoption benefits: If you received adoption benefits from your employer, you may need to report them on this form.

6. Refunds: If you received a refund of adoption expenses previously claimed on Form 8836, you must mention the amount received.

It is important to note that these are general guidelines, and you should refer to the official Form 8836 and its instructions for detailed information and any specific requirements. Additionally, it is recommended to consult with a tax professional or the IRS for precise guidance on filling out the form accurately.

When is the deadline to file form 8836 in 2023?

The deadline to file Form 8836 in 2023 is April 15th, 2024. However, if you file for an extension, you may have until October 15th, 2024 to submit your form. It's always recommended to double-check the specific deadlines with the official IRS website or consult a tax professional.

What is the penalty for the late filing of form 8836?

The penalty for late filing of Form 8836, which is used to claim the renewable electricity production credit, is generally $530 per form. This penalty applies if the form is filed after the due date, including extensions, or if it is filed with incomplete or incorrect information. However, the penalty may be waived or reduced if the taxpayer has reasonable cause for the late filing. It is always recommended to consult with a tax professional or the IRS for specific guidance on penalties and waiver criteria.

How do I edit form 8836 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing 8836 form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out the irs form 8836 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign form 8836 instructions. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit form 8836 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign 8836 form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your form 8836 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 8836 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.